Section 01: What is Economics?

What is Economics?

The term economics often brings to mind visions of equations, charts, and statistics. While each of these tools is useful, economics studies the decisions people make. Consider the following quote:

“There is a time and season for all of our decisions. Make sure you make decisions in the proper time and season. All of these life-altering decisions will be made in a very busy, relatively short period during your 20s—during what I call the ‘Decade of Decision.’”

Elder Robert D. Hales, April 2007

Preparing for the Decade of Decision

Even before we were born, we faced choices. The war in heaven was fought over agency or the ability to choose (see Moses 4:1-4). We face decisions daily: including what to have for dinner, what career to pursue, and whom to marry. Some decisions have eternal consequences while others are of lesser importance.

Although we are free to choose, we are not free to choose the consequences. Thomas S. Monson taught: “Decisions determine destiny. That is why it is worthwhile to look ahead, to set a course, to be at least partly ready when the moment of decision comes. (Pres. Thomas S. Monson, Life’s Greatest Decisions, CES Fireside, Sep. 7, 2003).

The fictional character Dumbledore in JK Rowling’s Harry Potter and the Chamber of Secrets reminds us that: “It is our choices... that show us who we truly are, far more than our abilities.”

With each decision we face trade offs - since something must be sacrificed or given up whenever a choice is made. Scarcity is the reason why we must make decisions; we have unlimited needs and wants but only limited time, money, and other resources. Resources spent on one activity cannot be spent doing something else. For example, taking the next hour to study economics prevents us from using that hour to study another subject, work, sleep, etc.

Likewise businesses and government face tradeoffs. How should a business spend their money to best meet the goals of the firm? How should the government allocate the generated tax revenues to address the many demands?

Even the Church leaders must decide how to use Church resources – should they build another temple or church house, use the funds for missionary work, or further the humanitarian effort?

In a market economy, price reflects the scarcity of a good or service. If at a zero price, the quantity demanded exceeds the quantity supplied, then the good or services is said to be scarce. In a market economy for traded goods and services, the more scarce the item the higher the price.

Since every choice made involves a trade-off, it also has a price. Something must be sacrificed in making the decision. Keep in mind that the price paid may or may not be in monetary terms. Pres. James E. Faust taught: “My dear young friends, there is another great truth that you young men must learn. It is that everything has a price. There is a price to pay for success, fulfillment, accomplishment, and joy. There are no freebies. If you don't pay the price that is needed for success, you will pay the price of failure. Preparation, work, study, and service are required to achieve and find happiness. Disobedience and lack of preparation carry a terrible price tag.” (James E. Faust, The Devil's Throat, Ensign, May 2003, 51).

Consider some examples of the way the price of a good changes as it becomes more or less scarce. For example, freezing temperatures in Florida will raise citrus prices. The cost for a 30-second advertisement slot during the Superbowl now costs more than $2.5 million. Can you think of other examples?

Scarcity is a key concept in economics. In fact, a good definition of "Economics" is the study of how individuals, businesses and societies attempt to make themselves as well off as possible in a world of scarcity, and the consequences of those decisions for markets and the entire economy.

Section 02: Guidelines to Thinking Like an Economist

Guidelines to Thinking Like an Economist

Just as learning a foreign language requires one to learn a new vocabulary, economics has its own language and way of thinking. Many of the problems and decisions we will face in life we have not previously encountered. For this reason, economics is a powerful tool, since it provides the framework for how to solve problems. Economist John Maynard Keynes taught: “It [Economics] is a method rather than a doctrine, an apparatus of the mind, a technique of thinking which helps its possessor to draw correct conclusions.”

Consider the following guidelines to thinking like an economist.

1. Every decision has trade-offs.

2. Individuals rationally pursue self-interest and respond to incentives.

3. In order to make rational decisions, relevant opportunity costs must be identified.

4. Compare the marginal benefits to the marginal costs.

5. Consider the secondary effects.

We will now consider each one of these guidelines in depth.

1. Every decision has trade-offs.

First, every decision has trade-offs. Because scarcity exists, we have to decide what the best use of our limited time and resources is. With each choice there is something we must give up.

“The Spirit has taught that Satan doesn't have to tempt us to do bad things, he can accomplish much of his objective by distracting us with many acceptable things, thus keeping us from accomplishing the essential ones. We need to frustrate that distraction by identifying what is critically important in our lives. We must give the cream of our effort to accomplish those things. Where there is limited time or resources, this pattern may require that some good activities must be set aside."

Elder Richard G. Scott, To Learn and To Teach More Effectively, Aug. 21, 2007

2. Individuals rationally pursue self-interest and respond to incentives.

Second, individuals rationally pursue self-interest and respond to incentives. In economics, we assume that people act rationally, that people weigh out the benefits and costs of each decision as they best know them. Given that information is often incomplete, rational choices depend on the perspective, as well as the preferences of the decision maker. In Proverbs 12:15 we read: “the way of a fool is right in his own eyes.” As a result, what may seem rational to one individual may be considered irrational by another. Still, assuming rationality is useful in explaining how individuals make choices because rationality suggests that people respond to incentives. That means individuals will make different choices when circumstances (or incentives) change.

Incentives come in various forms – on one hand is the stick approach which provides a punishment for inappropriate behavior. The threat of a ticket or jail discourages individuals from undertaking certain activities. On the other hand, the carrot approach offers a reward for a particular choice or behavior.

Adam Smith, who is considered to be the father of modern economics, wrote a book in 1776 entitled the Wealth of Nations. In it, he talked about how people act in their own self-interest. A baker does not get up early each morning to bake bread solely because of his love for his fellow man, but because by making bread he earns an income which allows him to provide food, clothing, and shelter for his family. As a result of each person acting in their own self-interest, the goods and services we desire in our economy are produced. Consequently, government does not need to dictate what businesses should produce because each person acting in their own interest in turn promotes the best interest of society – as if led by an invisible hand. Each individual, seeking only his own gain, "is led by an invisible hand to promote an end which was no part of his intention," that end being the public interest. "It is not from the benevolence of the butcher, or the baker, that we expect our dinner," Adam Smith wrote, "but from regard to their own self interest.” Consider the following quote:

"How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortune of others, and render their happiness necessary to him, though he derives nothing from it, except the pleasure of seeing it.”

--Adam Smith, The Theory of Moral Sentiments

A common misconception is that self-interest means greedy. Not all decisions are about money. Acting in one’s self-interest means pursuing those activities that bring the greatest joy or satisfaction to an individual, which may actually include service or philanthropic acts. While these do not increase the financial status of an individual, they may bring the individual great satisfaction. (Reference: http://www.econlib.org/Library/Enc/bios/Smith.html)

3. In order to make rational decisions, relevant opportunity costs must be identified.

The third guideline to thinking like an economist is to identify the relevant trade-offs. Due to scarcity, each choice we make requires us to sacrifice or give something up. Opportunity cost is the highest value trade-off--the value of the next best option foregone.

Have you ever passed up a “free” dinner? If so, why? Maybe it was because the free dinner required you to listen to a sales pitch or spend the evening out when you would rather be at home or out spending time with someone else. When we consider the opportunity cost, it is not only the money foregone but also the value of our time.

Elder Oaks taught: “We should begin by recognizing the reality that just because something is good is not a sufficient reason for doing it. The number of good things we can do far exceeds the time available to accomplish them. Some things are better than good, and these are the things that should command priority attention in our lives.” (Dallin H. Oaks, “Good, Better, Best,” Liahona, Nov 2007, 104–8).

Assume we have three different investment opportunities, each requiring a one-hundred dollar investment. If we have $100 to invest in one of three projects (assuming each project has the same level of risk) we would invest in the project that yields the highest return, project A. By investing in project A, we would forgo the opportunity to invest in projects B and C. Note that if we had not invested in project A, we could not invest in both B and C. Since project B is the highest value of the foregone opportunities, that becomes our opportunity cost.

Return on the investment opportunities:

A. $130

B. $110

C. $101Investment cost = $100

In his general conference address, Elder Oaks taught:

Jesus taught this principle in the home of Martha. While she was “cumbered about much serving” (Luke 10:40), her sister, Mary, “sat at Jesus’ feet, and heard his word” (v. 39). When Martha complained that her sister had left her to serve alone, Jesus commended Martha for what she was doing (v. 41) but taught her that “one thing is needful: and Mary hath chosen that good part, which shall not be taken away from her” (v. 42). It was praiseworthy for Martha to be “careful and troubled about many things” (v. 41), but learning the gospel from the Master Teacher was more “needful.”

(Dallin H. Oaks, Good, Better, Best, General Conference Oct. 07)

In order to assess opportunity costs, and thus make the best decisions, we need to be able to identify the relevant costs. Costs can be broken down into two broad categories – explicit and implicit.

An explicit cost is an out-of-pocket monetary expense for use of a resource owned by someone else. To obtain the use of a building, one would have to pay a monthly rent to the owner. An implicit cost is a foregone opportunity cost to the owner of the resource. For example, farmers who own their own land do not have to pay a land rent (i.e., there is no explicit cost). However, using the land still implies an opportunity cost because the next best alternative would be to rent the land to someone else. Lost rent is therefore an implicit cost.

Economic decisions should account for both the explicit or out-of-pocket expenses as well as the implicit costs – the opportunity cost of using the resource in a different way.

Students incur both explicit and implicit costs when attending school. Explicit costs would include out-of-pocket expenditures such as tuition, books, and fees while implicit cost would include the highest value of the next best use of ones time. If instead of going to school, the next best use of a students time would be working, then the implicit cost would be the value of the wages that could have been earned instead of going to school.

| Explicit Costs | Implicit Costs | |

| Definition: | An out-of-pocket monetary expense to obtain the use of a resource. | An opportunity cost to the owner of the resource |

| Examples: | Building rent, employee wages | Foregone rent to the land owner |

Practice

Consider the following scenario:

Your family is taking week long summer vacation at a cabin in the mountains next to a lake. You have been able to get time off work at the job where you normally work 40-hours a week at $12 per hour. Your parents are paying $1,500 for the cabin rental and each child will pay $200 for food and other related costs. You currently have your own rented apartment with a monthly rent of $300 and typically pay $75 per week for food. The travel cost to get to the cabin and back will cost you $50 more than your usual weekly travel expenses.

What are your explicit costs of the summer vacation?

$200 - $75 + $50 = $175

What are your implict costs of the summer vacation?

Foregone earnings from work: $480

4. Compare the marginal benefits to the marginal costs.

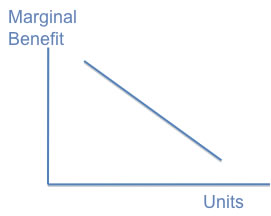

The fourth concept is to compare the Marginal Benefit to the Marginal Cost. The term marginal means additional. Marginal benefit is the additional benefit (e.g., the increase on a test score from studying one more hour; the additional return from producing one more unit of output; or investing an additional dollar).

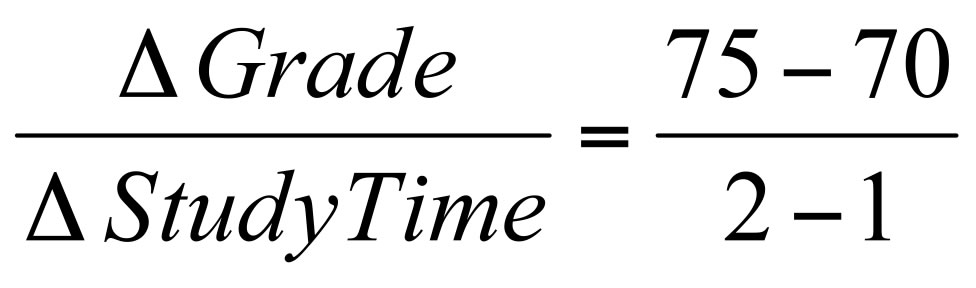

If by studying a second hour for an economics exam the score increases from 70 to 75, then the marginal benefit of that additional hour would be five points. We will let the Greek letter Delta (Δ) represent or mean the change. Thus the marginal benefit is calculated by the change in our test score divided by the change in our study time.

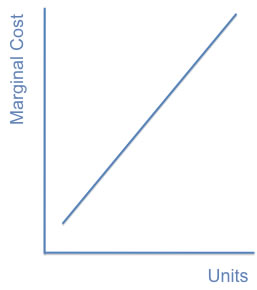

The Marginal Cost is the additional cost of undertaking an activity. The Marginal Cost measures the additional value of what has to be sacrificed or given up. Instead of studying an additional hour for an exam, one may have used that time in a variety of other ways, for example to work, to sleep, or to study another subject. Recall that opportunity cost is the value of the next best option, and that value becomes the marginal cost. If studying math for the next hour was the next best option and the math test score would have increased by four points, then the marginal cost of studying economics for the next hour would be the four point increase on the math test. If the individual chooses to study economics instead of math, it would imply that the value of additional five points in economics is worth more than the value of the additional four points in math.

Comparing Marginal Benefit to Marginal Cost

When making decisions, the marginal benefit should be compared to the marginal cost. As long as the marginal benefit is greater than or equal to the marginal cost, then the choice would be rational.

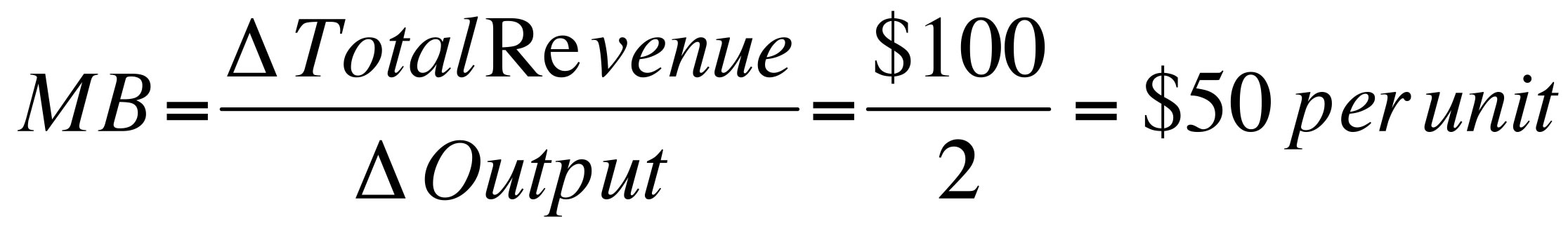

If a firm, by producing two more units of output can increase total revenue by $100, then the marginal benefit or marginal revenue per additional unit of output would be $50. This is computed by taking the change in total revenue divided by the change in output.

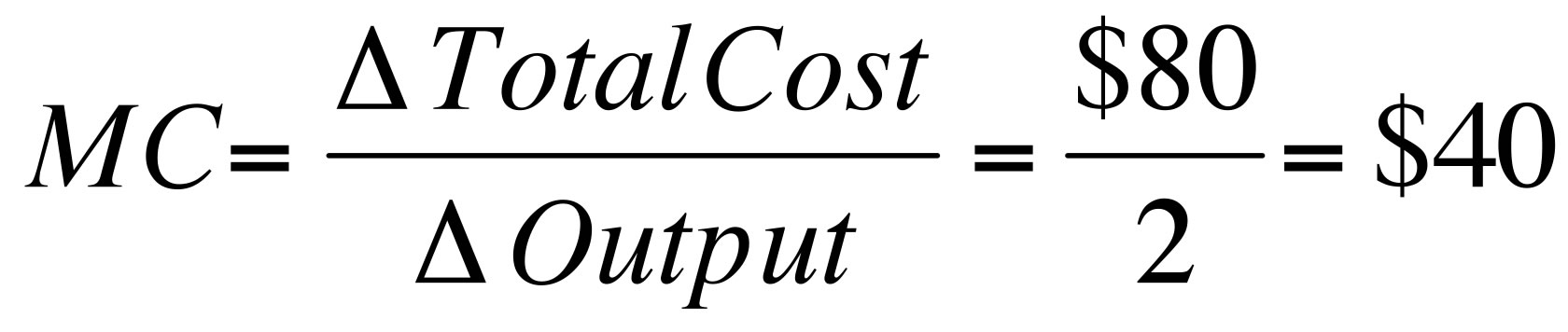

If costs increase by $80 by producing two more units of output, then the marginal cost per unit of output would be $40. A marginal benefit of $50 compared to the Marginal Cost of $40 would indicate that this would be a wise choice.

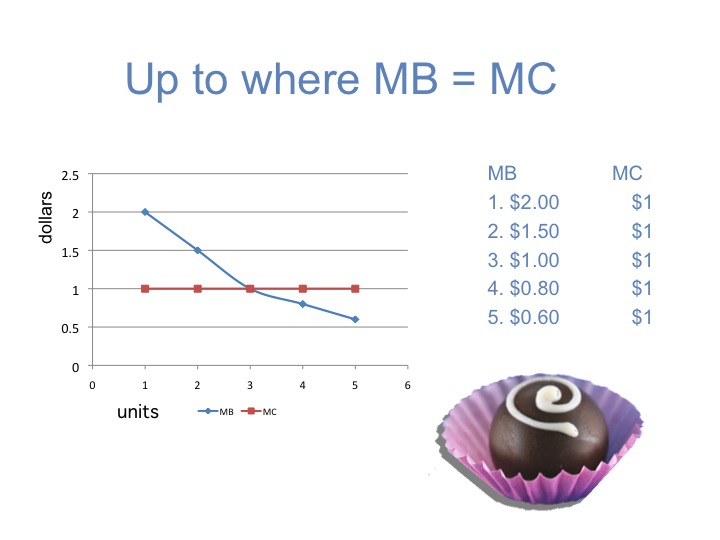

Although we may not explicitly write down the marginal benefit and marginal cost of each choice we face, we subconsciously do this every time we make a choice. Say that we are at a gourmet chocolate factory, each chocolate (its marginal cost) is $1. Since we get less satisfaction from each additional chocolate consumed, the marginal benefit per chocolate declines. For demonstration purposes we will assume the following marginal benefit per chocolate: $2, $1.50, $1.00, $0.80 and $0.60, respectively. To determine how many chocolates to purchase, we would compare the marginal benefit to the marginal cost. Would you spend one dollar to get two dollars of value? Certainly. We then go to the second – we would be willing to spend a dollar to get $1.50? Yes. At the third chocolate we become indifferent since we are spending a dollar to get a dollar of value back. Our decision rule is to go up to the point where the marginal benefit equals the marginal cost since there is no other place that would make us better off. Since the fourth and fifth chocolates yield less value than their cost, we would only want to purchase three chocolates.

It is not uncommon for businesses to operate at the margin for only a fraction of a cent. In the foreign exchange and commodities markets, traders often make money by making only a fraction of a cent per unit, yet by buying and selling large quantities this small gain results in large profits.

Have you ever wondered why the top of a pop can curves in? Years ago, cans use to be cylinder shaped without tapering in. Since the top and bottom of a can require a greater metal thickness, manufacturers found that by slightly reducing the diameter they could reduce the cost per can. While the change saves the manufacturer only a small amount per can, the savings are substantial when one considers the total number of cans produced annually.

The Law of Diminishing Marginal Returns

An important concept in marginal analysis is to recognize the law of diminishing marginal returns. As more units are consumed, the marginal benefit from an additional unit will eventually decline. For example, for each additional hour spent studying, the marginal increase in one’s grade will typically decline. There may even come a point where another hour of study would reduce the exam score. After 21 hours of study, it would be better to go to sleep than try to study another hour.

Increasing Marginal Cost

On the other side, the marginal cost typically increases as more of something is undertaken. As additional units are produced, the cost per additional unit will eventually rise. For example, the opportunity cost of the first hour of study may be some free time, but the opportunity cost rises with each additional hour of study as activities with a greater value have to be sacrificed.

Short- and Long-Term Impacts

Another important principle to remember when comparing the marginal benefit and marginal cost is to remember both the short and long term impacts of a decision. A company that chooses to produce a faulty product may make large profits in the short run, but be subject to huge losses from recalls and lawsuits in the long run. Thus both the short and long term should be considered when making a choice.

For what shall it profit a man, if he shall gain the whole world, and lose his own soul? (Mark 8:36)

Remember that marginal means additional – what is the additional benefit compared to the additional cost? When making choices, rationality suggests that we focus on the marginal costs and we ignore costs that have already been incurred or sunk and cannot be recovered. Let’s use the example of a student who purchased a car for $6,000 and had planned to sell it for $6,500 this week. Last night, he drifted off the road damaging the car. Since he only carried liability insurance, there will be no help from the insurance company. In its damaged state, the car will sell for $2,500. It will cost $2,000 for the body shop to fix the car that would then sell for $5,000. Should the student fix the car or not?

The answer to this problem has nothing to do with what he paid for the car or the planned sale price. In making this decision, the relevant question is: will it be better to sell the car as is or fix it up and then sell it? Selling the car as is, he will make $2,500. If he repairs the car and then sells it, he will incur an additional cost of $2,000 and increase the amount he is able to sell the car by $2,500. Thus, he should fix up the car and sell it since the marginal benefit is greater than the marginal cost.

|

|

| Those costs that cannot be recovered. | |

|

|

| Purchase price | $6,000 |

| Planned sale price | $6,500 |

| Sale value of damaged car | $2,500 |

| Cost of repair | $2,000 |

| Sale value after repair | $5,000 |

5. Consider the secondary effects.

The last guideline to thinking like an economist is to consider the secondary effects--the impacts a choice or decision will have on others and how others will react.

For example, in the name of safety, the Federal Aviation Administration (FAA) once considered a regulation that would require all airline passengers to have their own seats, even small children. When they examined how many passengers with children would stop flying and drive to their destination instead, they concluded that the regulation would actually increase the number of deaths because of the frequency of car accidents.

The Federal government's choice to bail out those impacted by a natural disaster such as a flood or fire, may be made with good intentions. However, the secondary effect may be to encourage people to live in more high risk areas or not purchase proper home insurance since they believe that the government will again come to their rescue.

Many banks and other institutions that took extraordinary financial risks were bailed out by the federal government. What incentive will this provide to those institutions with respect to taking on future financial risks?

Section 03: Microeconomics vs. Macroeconomics

Microeconomics vs. Macroeconomics

Economics can be broken down into two broad categories – microeconomics and macroeconomics.

Microeconomics focuses on the one. The behavior and decisions of an individual, firm, industry, or market and the resulting impact on the prices of specific goods, services, and resources. Macroeconomics focuses on the economy as a whole and the behavior of aggregate sectors such as consumers, businesses and government. Inflation, unemployment, and the business cycle are macroeconomic topics.

Although microeconomics and macroeconomics are interrelated, macroeconomics focuses on the forest as a whole, while microeconomics focuses on the individual trees. Just as no one raindrop is to blame for the flood, no one consumer or producer can cause the ups and downs in the economy. Yet collectively consumers and producers will determine where the economy goes.

Like other sciences, economics relies on the scientific method. Theories are developed and hypotheses are tested. When we fail to reject the hypothesis and find that people behave in a particular way under the same conditions, we develop a law or a principle.

One such law in economics, for example, is the law of demand. It states that as the price of a good increases, the quantity demanded decreases and as the price of the good decreases, the quantity demanded increases.

Since we live in a very complex world, it is often difficult to understand relationships. Thus we create models that allow us to abstract from the real world all of the essential information to understand a particular relationship. We then assume that the other nonessential factors are held constant. The term ceteris paribus is a Latin phrase that means holding all else constant.

We often use models to increase our understanding. For example, a road map is a model or an abstraction from reality that gives us the essential information to get from point A to point B even though it does not show every curve in the road. Likewise, an economic model provides the essential information to understand how individuals will behave.

Positive Analysis vs. Normative Analysis

As business and government formulate policies they are often applying positive analysis to normative goals. Positive analysis focuses on the facts or cause-and-effect relationships. Examples of positive analysis include: the room temperature is 70 degrees or the unemployment rate is 5 percent.

Normative analysis requires an opinion or value judgment about what should or ought to be. The minimum wage should be $3 more per hour. The answer depends on the opinion of the individual. Economics often uses positive analysis to make a normative decision.

Identify the following statements as positive or normative. The answers are below: n = normative and p = positive.

1. The price of apartment rent is too high.

2.

A decrease in tuition will cause more students to attend college.

3. The government should offer more small business loans.

4. A ten percent increase in major league baseball tickets will reduce the quantity demanded by 2.3 percent.

Answers

1. n

2. p

3. n

4. p

In understanding cause and effect relationships it is important to distinguish between correlation and causation. If two variables are correlated there is a dependable relationship between how the two variables change. For example, if you lived on a farm, you might observe that every morning the rooster crows then the sun comes up. Are these two correlated? Certainly. However, to conclude that the rooster crowing is causing the sun to come up would be erroneous. The post hoc fallacy is the false belief that just because something precedes something else it must therefore be the cause. Other relationships have both correlation and causation. You might observe that when it rains the river rises. The two are correlated, and the additional rain is the cause of the increased height of the river.

Another pitfall is the fallacy of composition--what is true or good for one is therefore true or good for all. For example, if I stand up in the middle of a ball game, it is true that I will have a better view of the game. The fallacy of composition would propose that if everyone would stand up at the ballgame, they would all have a better view. This is not necessarily true. Another example is if I owned a gas station, I may make greater profits if I lower the price of my gas. The fallacy of composition would be that all gas stations would make greater profits. However, if all firms lower the price of their gas, their profits may not be greater than they are right now.

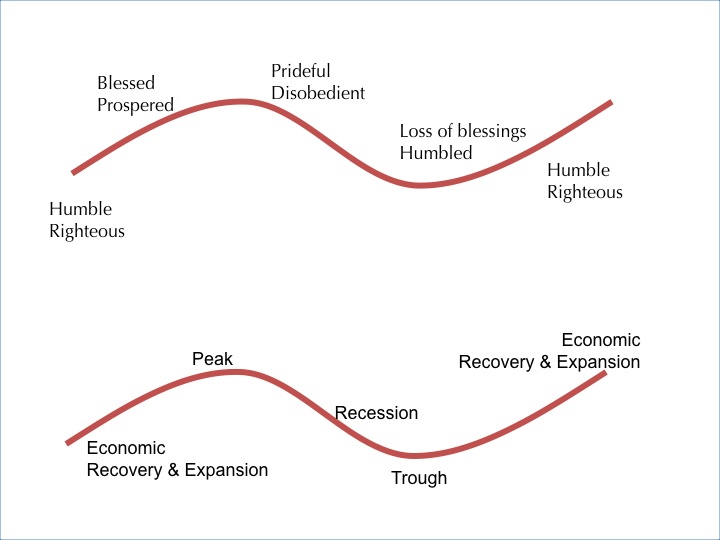

An important reason to study the Book of Mormon is to learn of the circumstances that brought about the people's downfall. If we understand the pride cycle, we may learn how to prevent it in our own lives. Abraham Lincoln said: "What has once happened, will invariably happen again, when the same circumstances which combined to produce it, shall again combine in the same way."

Likewise in economics, we often study the past to learn about the circumstances that brought about certain conditions in our economy. By understanding how individuals react when faced with a particular set of circumstances, we can better predict how individuals will behave when faced the same set of circumstances.

Practice

Step 01: Identify three major decisions you will make in the next five years.

Step 02: Identify the opportunity costs associated with each decision.