Money

This lesson introduces us to the role of money in our economy, the American Banking system (including the Federal Reserve System of the United States), and the use of monetary policy to manipulate price levels and employment in the US economy.

Section 01: The Functions of Money

Money fulfills three primary functions in our economy: It is a medium of exchange, it is a measure of value, and it is a store of value. Let’s consider each of these functions in turn.

Medium of Exchange

Money is the means by which we purchase goods and services. If there were no money, we might suppose that we would exchange goods and services directly for each other in a barter system. It does not take much imagination to see how money is useful to facilitate exchanges that would be difficult by barter. Imagine taking a pig into and shoe store and trying to exchange it for a pair of tennis shoes. This situation is fraught with all sorts of difficulties. What if the owner of the tennis shoes does not happen to want a pig or any portion of a pig? What about the fact that the pig might be worth 5 pairs of tennis shoes and you only want one pair? Is it reasonable that the shoe store owner can accept only 1/5 of a pig for a pair of tennis shoes? How would he be able to do this? Money facilitates the exchange, because everyone is willing to accept money as a medium of exchange for whatever it is that one might want to buy or sell. It is also very easily divisible to the scale of what is being exchanged.

Measure of Value

Money is also a measure of value and acts as a yardstick for measuring the relative worth of heterogeneous goods. It might be difficult to know off the top of your head that a pig is worth ten pairs of tennis shoes, but money makes this easy to measure. If a grown pig can be sold for $300 and a pair of tennis shoes can be sold for $60, then we can say that a pig is worth 5 pairs of tennis shoes. Money makes this calculation possible because it is a measure of value. How much regular gasoline could you trade for a pound of roast beef? The answer to that question might not be obvious to you at first blush. Let’s say that you were told, however, that sliced roast beef at the Deli counter at Broulim’s Grocery Store is $7.00 a pound and that regular gasoline at the Maverick Gas Station in Rexburg ID is $3.50 a gallon. Now you would know that you could get two gallons of regular gasoline for one pound of roast beef, and money as a measure of value provides you with the answer!

Store of Value

Money is a store of value because it is a liquid (or spendable) source of wealth. Some people choose to hold on to money as an asset, just like they might have a home, a painting, or a diamond ring. Money has an advantage over other assets because it is very liquid. The liquidity of an asset refers to how quickly the asset can be turned into cash, and since money is already cash, it is the most liquid asset possible! This is probably the reason that so many people hold onto cash as a store of value, as will be seen when we talk about the components of the money supply.

Section 02: The Money Supply

There are two widely used definitions of the money supply. One is a more narrow definition and the other is a broader definition. We will look at both.

M1

The first definition of the money supply is called M1. M1 consists of currency and coins in the hands of the non-bank public, traveler’s checks, and checkable deposits. Currency and coins constitutes about 50% of M1 and checkable deposits make up the other 50%. Traveler’s checks make up far less than 1% of M1. As of April, 2011, M1 was $1,900,900,000,000, or nearly two trillion US dollars.

M2

The second definition of the money supply is called M2. M2 is a broader and less liquid definition of the money supply. While M1 constitutes money that is either cash or readily changed to cash, M2 includes more types of money and specifically parts of the money supply that are harder to turn into cash. M2 consists of M1, Savings Deposits, Small Time Deposits ($100,000 or less), and Money Market Mutual Funds. M1 makes up about 21% of M2, Savings Deposits account for 61% of M2, Small Time Deposits make up 10% of M2, and Money Market Mutual Funds constitute approximately 8% of M2. As of April 2011, M2 was 8,946,100,000,000 or nearly nine trillion US dollars.

Section 03: Demand for Money

Given our explanations of the functions of money, it will not be surprising that there are two different types of demand for money. The first is called the transactions demand and the second is called the asset demand.

Transactions Demand

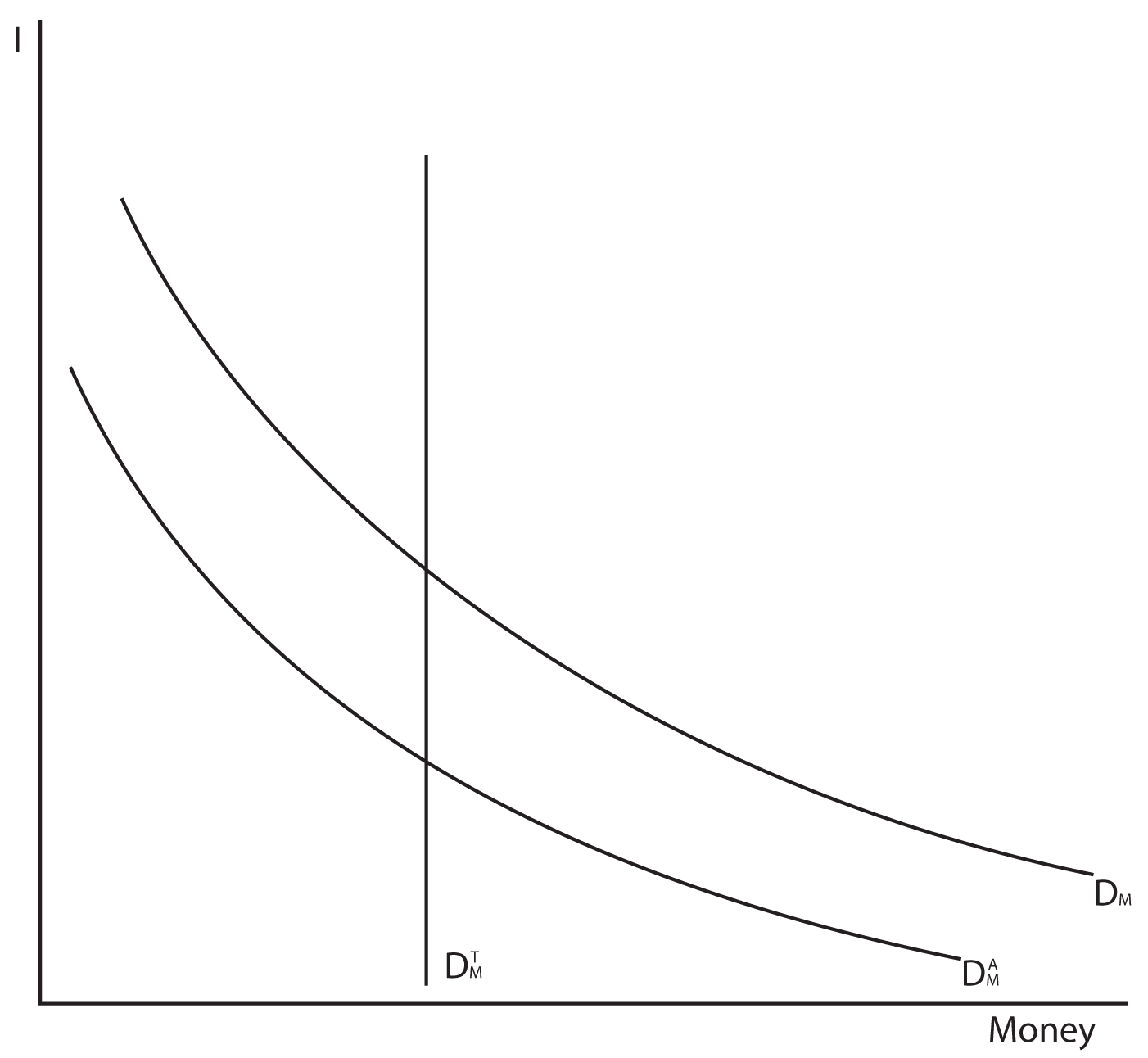

On a daily basis people need money on hand for the things that they routinely buy. You have to get a haircut or stop by the store on the way home from work to pick up some milk. You have transactions that you need to conduct, and therefore you have a demand for money. The transactions demand for money is using money as a medium of exchange. Notice in the graph below that the Transactions Demand for Money (DMT) is denoted as a vertical line when graphed against the interest rate. The demand for money as a medium of exchange is independent of the interest rate, because when you are on your way home from work and need to pick up milk, the interest rate does not affect how much milk you buy.

Asset Demand

Some people hold money as a financial asset just like stocks and bonds. Holding money as a liquid asset is using money as a store of value. Consider a person who has a portfolio of investments. Perhaps he owns some stocks, bonds, jewelry, artwork, a home, a savings account at his credit union, and has $5,000 in a fireproof box hidden in his basement. In an emergency, the cash is the most liquid asset that the person has, and is far more spendable than a painting or a piece of jewelry that might take weeks to turn into cash. The liquidity of cash is the advantage of holding cash. The disadvantage of holding money as an asset is that there is very little or no return on this asset.

The cost of holding money as an asset is the foregone interest rate and there is an inverse relationship between the interest rate and the asset demand for money. This inverse relationship is illustrated in the graph below as a downward sloping asset demand for money (DMA). The total demand of money (DM) is just the sum of the transactions demand and the asset demand, and has the same downward slope as the asset demand.

Section 04: The Money Market

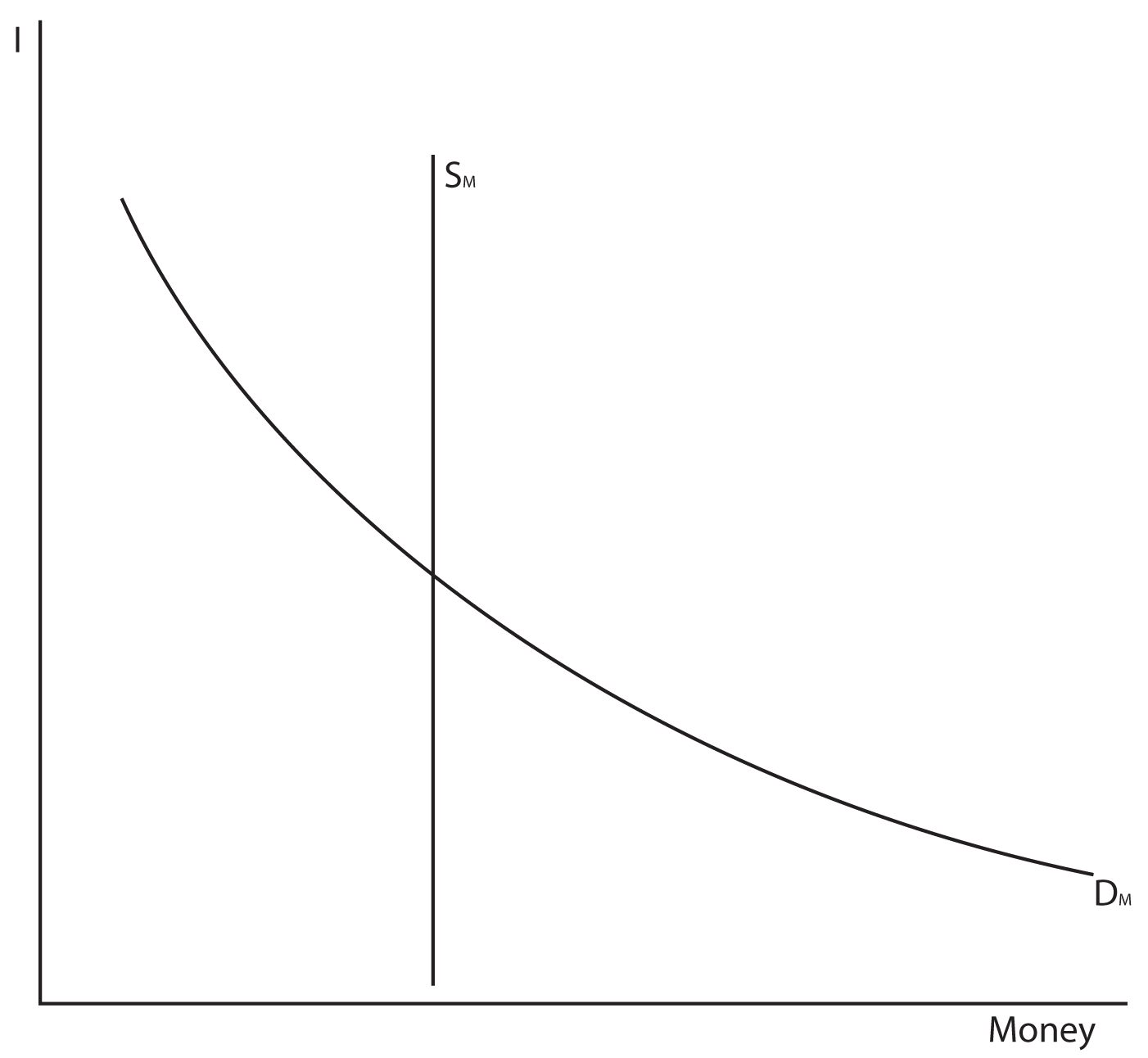

We will make a simplifying assumption that the supply of money is set by Federal Reserve policy, and is therefore shown graphically as a vertical line.

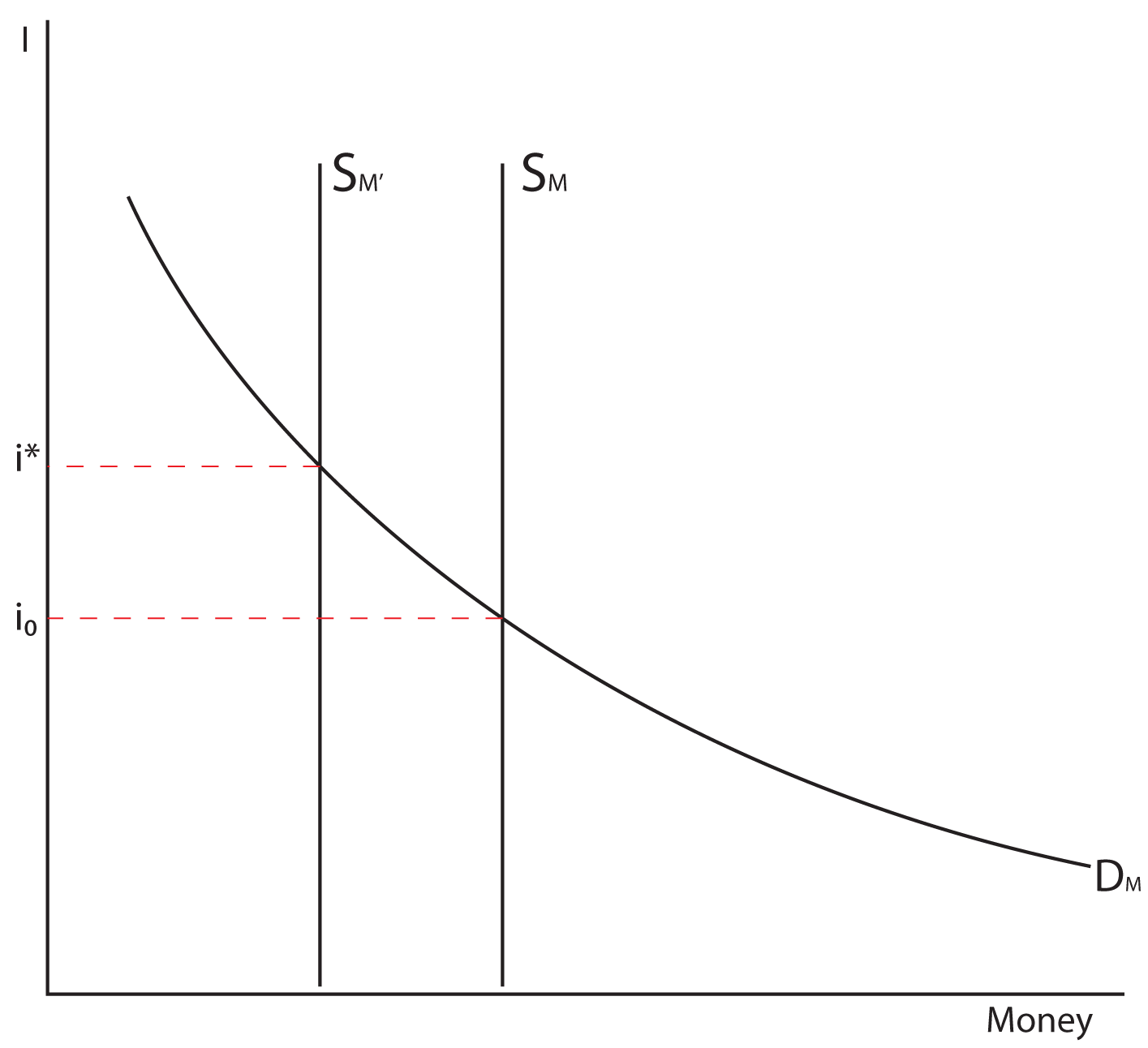

Adjustments to a Decrease in the Supply of Money — When the supply of money decreases (shifts to the left) the interest rate goes up.

Adjustments to an Increase in the Supply of Money — When the supply of money increases (shifts to the right) the interest rate goes down.

Adjustments to a Decrease in the Demand for Money — When the demand for money decreases (shifts to the left) the interest rate falls.

Adjustments to an Increase in the Demand for Money — When the demand for money increases (shifts to the right) the interest rate goes up.

The above four statements can be easily illustrated by shifts in the graph above, but can you see the logical economic argument behind each? Let’s illustrate with the first statement and then you work through the similar logic on the other three.

What would happen if there were a decrease in the Supply of Money from SM to SM’? If you stay at the old interest rate of i˳ when the supply of money falls, then the demand for money will exceed the supply of money. What would you do if you were running a bank and more people came in demanded money than there were coming in and supplying money? Wouldn’t your natural reaction be to increase the interest rate in the hope that the higher interest rate would decrease the demand for money? Remember that at a higher interest rate, the asset demand for money will be less. As the interest rate goes up, the demand for money and the supply of money will eventually come into equilibrium again at a higher interest rate, say i*. You can use similar logic to analyze each of the other three scenarios.

Return to the course in I-Learn and complete the activity that corresponds with this material.

Section 05: Why are there so many interest rates?

Our previous discussion referred to the interest rate as though there was only one in the economy. The reality is that there are many interest rates. The interest rate on your credit card is different than the interest rate for a car loan, which is different than the rate you might be charged on a home loan. Let’s consider four factors that will influence the interest in any given situation.

- Term or maturity

- Shorter term loans have a lower i

- Longer term loans have a higher i

- Risk

- Riskier loans have a higher i

- Safer loans have a lower i

- Liquidity

- Liquid loans have a lower i

- Illiquid loans have a higher i

- Administrative Costs

- Loans that have a high cost to administer have a higher i

- Loans that have a low cost to administer have a lower i